All Categories

Featured

Table of Contents

One of the critical facets of any type of insurance plan is its expense. IUL plans usually come with different costs and fees that can influence their general value.

But don't just take into consideration the costs. Pay certain interest to the plan's attributes which will be essential relying on exactly how you wish to use the plan. Talk to an independent life insurance policy representative that can assist you choose the ideal indexed global life policy for your demands. Full the life insurance coverage application in full.

Review the policy very carefully. If satisfactory, return authorized distribution receipts to obtain your global life insurance policy protection effective. Make your very first premium repayment to trigger your plan. Now that we have actually covered the advantages of IUL, it's important to understand just how it contrasts to various other life insurance policy policies available in the marketplace.

By understanding the resemblances and differences in between these plans, you can make an extra educated decision about which sort of life insurance policy is best suited for your demands and monetary objectives. We'll begin by comparing index global life with term life insurance policy, which is usually thought about one of the most simple and budget friendly kind of life insurance policy.

Who offers flexible Iul Growth Strategy plans?

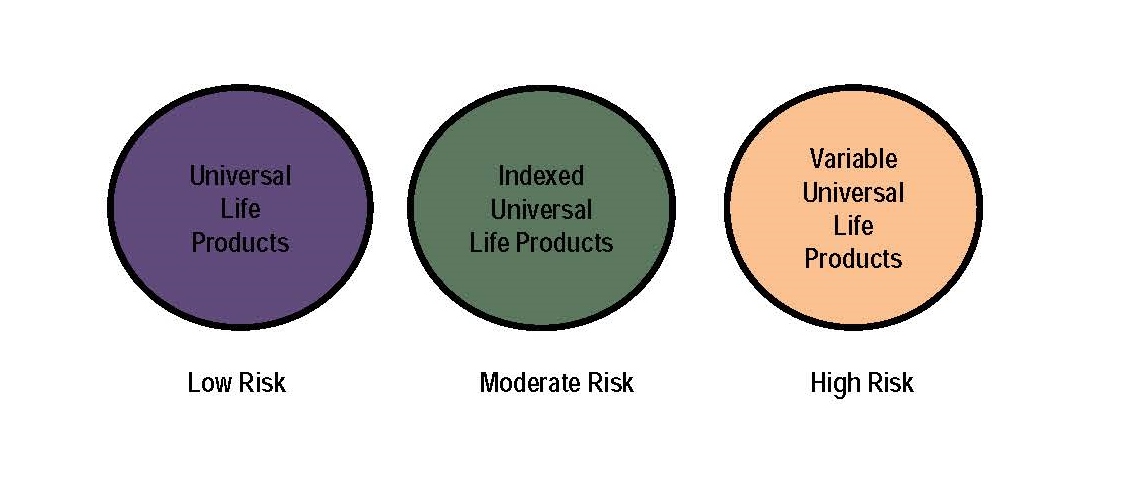

While IUL might supply higher possible returns due to its indexed cash money value growth device, it additionally comes with greater costs compared to describe life insurance policy. Both IUL and whole life insurance policy are types of long-term life insurance policies that give death benefit protection and cash worth growth chances (Guaranteed Indexed Universal Life). There are some key distinctions between these two kinds of plans that are crucial to take into consideration when making a decision which one is best for you.

When thinking about IUL vs. all other types of life insurance policy, it's critical to weigh the benefits and drawbacks of each policy type and seek advice from a skilled life insurance policy agent or financial advisor to identify the ideal alternative for your unique requirements and monetary goals. While IUL offers many advantages, it's additionally important to be conscious of the risks and considerations related to this kind of life insurance policy plan.

Let's dig deeper into each of these dangers. One of the key issues when considering an IUL policy is the various expenses and fees associated with the plan. These can consist of the cost of insurance, policy fees, surrender fees and any kind of extra motorcyclist prices incurred if you add extra advantages to the plan.

You desire an IUL plan with a range of index fund options to satisfy your requirements. An IUL plan need to fit your details scenario.

What should I look for in a Iul Death Benefit plan?

Indexed universal life insurance can offer a number of benefits for insurance holders, consisting of adaptable costs repayments and the possible to earn higher returns. The returns are limited by caps on gains, and there are no assurances on the market efficiency. Overall, IUL plans offer several prospective advantages, yet it is very important to recognize their threats also.

Life is not worth it for the majority of individuals. For those looking for predictable long-term savings and assured death benefits, whole life may be the better alternative.

How do I choose the right Long-term Iul Benefits?

The benefits of an Indexed Universal Life (IUL) policy include possible greater returns, no disadvantage risk from market movements, protection, versatile repayments, no age requirement, tax-free survivor benefit, and finance accessibility. An IUL policy is long-term and supplies money value growth via an equity index account. Universal life insurance coverage started in 1979 in the USA of America.

By the end of 1983, all significant American life insurers offered global life insurance policy. In 1997, the life insurance firm, Transamerica, presented indexed universal life insurance policy which offered insurance holders the capability to link plan development with international stock exchange returns. Today, universal life, or UL as it is likewise known is available in a variety of different types and is a huge part of the life insurance policy market.

The information supplied in this write-up is for academic and informative purposes only and need to not be understood as monetary or investment guidance. While the author possesses proficiency in the subject, viewers are encouraged to seek advice from a certified financial expert before making any investment decisions or buying any life insurance policy items.

Indexed Universal Life Tax Benefits

As a matter of fact, you may not have actually assumed much regarding how you intend to invest your retirement years, though you probably understand that you don't intend to run out of money and you want to maintain your current lifestyle. [video: Text appears next to the business man speaking to the camera that reads "company pension", "social security" and "savings".] < map wp-tag-video: Text appears beside business guy speaking with the video camera that reads "firm pension", "social security" and "cost savings"./ wp-end-tag > In the past, individuals trusted 3 major incomes in their retirement: a firm pension plan, Social Safety and whatever they 'd handled to conserve

Less companies are using conventional pension plan strategies. Also if benefits have not been reduced by the time you retire, Social Safety alone was never intended to be sufficient to pay for the lifestyle you desire and should have.

Before committing to indexed universal life insurance policy, right here are some advantages and disadvantages to consider. If you pick a good indexed global life insurance policy plan, you might see your money value grow in value. This is handy due to the fact that you might have the ability to gain access to this money before the strategy ends.

How do I get Iul Growth Strategy?

Given that indexed global life insurance policy needs a specific level of danger, insurance coverage companies tend to keep 6. This type of strategy likewise uses.

Usually, the insurance policy firm has a vested passion in carrying out far better than the index11. These are all factors to be taken into consideration when picking the ideal kind of life insurance for you.

Nonetheless, because this kind of plan is extra intricate and has an investment element, it can usually come with higher premiums than other plans like whole life or term life insurance coverage - High cash value IUL. If you don't assume indexed global life insurance policy is right for you, below are some options to consider: Term life insurance is a momentary policy that normally provides insurance coverage for 10 to three decades

Latest Posts

Universal Benefits Corporation

Best Indexed Universal Life Policies

Life Insurance Stock Market